State of DCA Tools on EVM

Interestingly, we are in a pre-bull market or a bull market, so DCAing may not seem the best strategy, as buying up during the low phase of the market makes sense. For all those, who have accumulated, maybe they can use DCA to exit their bags systematically.

I was seeing a lot of interest around DCA tools that support EVM on timeline and TG groups, so thought to aggregate all the tools I have found till now. DCA orders are also known as TWAP orders - Time Weighted Average Price. DCA is used in terms of investment context and TWAP is more from a trader's perspective. TWAP allows whales/ Institutions to deploy large orders, and minimize the price impact and market presence in markets.

A lot of people understand what DCA is, but still lets, look at the definition as per Investopedia - ‘‘ An approach to purchasing an investment in which the buyer spreads out their purchases so that the total price paid is less affected by market timing ’’

There is an ecosystem of DCA tools on EVM Chains. We will cover each of these projects.

Mean Finance

Website: https://mean.finance/create | Twitter: https://twitter.com/mean_fi

Mean Finance has been operational since 2021, enabling the DCA (Dollar-Cost Averaging) of any ERC-20 token into another. It is available on seven chains: Ethereum, Polygon, Optimism, Arbitrum, BNB Chain, Gnosis Chain, and Moonbeam, charging a 0.6% fee on every swap. While there are gas fees associated with creating, modifying, withdrawing, and terminating positions, the swaps themselves are gas-less. One area where Mean lacks is granularity in terms of minutes and hours, which would significantly enhance its value.

Main highlights:

Gas-less DCA transactions

No requirement to set up a smart account

Opportunity to earn yield on deposits

How to create a DCA order?

To create a DCA order, a user selects the ERC-20 token they wish to swap both from and to, then specifies the amount of the token to be swapped. Following this, they set the time interval for the swap. An additional feature allows for generating yield on idle assets, as swaps will occur according to the specified period, enabling the use of idle capital/tokens. Mean integrates with Aave, Yearn, etc., and depending on the tokens involved, a user can opt-in to maximize capital efficiency. Mean offers two options: daily and weekly, allowing users to decide over what time period they want to run their order. Mean also supports updating your positions, meaning you can add more amount to the existing order, change the time interval. These actions involve gas fees.

Let's take an example: Bob has 1,000 USDC and wants to swap it for WETH. He selects USDC under "Sell" and WETH under "Receive," then enters 1,000 in the amount to invest, and finally specifies the time period for this. Afterwards, it shows the total amount to be swapped entered by the user and the calculated amount of swap that will happen. There's also an option to opt-in for yield. Then, a user approves a token and deposits it into the smart contract. The protocol returns an NFT (ERC-721) as a position, which contains all related information, similar to a Uniswap V3 NFT.

How does the protocol function?

A user sets up the position, creating an intent to swap one token for another. Then, as these deposits are in a smart contract, an external user, which could be a market maker, executes the positions on behalf of the user, considering all details related to the position. When the external user swaps the token, a 0.6% fee is deducted from the swap, which is split between the Mean treasury and market maker fees. Since orders are executed by a third party, no gas fee is charged to the user.

Note: Mean can pause swaps if the smart contracts are vulnerable to an exploit. Users will still be able to withdraw funds from their positions during the paused period.

CoWswap

Website: https://cow.fi/ | Twitter: https://twitter.com/CoWSwap

CoWswap is a Meta DEX aggregator, known for offering better prices and MEV-resistant swaps. It supports only Ethereum mainnet and Gnosis Chain. CoW features TWAP orders as a product, which stands for Time Weighted Average Price Orders, or we could call it DCA. CoWswap has processed around $178M in total volume of TWAP orders. This functionality only works with Safe - a smart-contract wallet. On the Mainnet, the minimum TWAP order size is $5k. Cowswap does not charge any platform fees. It also provides a gas-less experience, as gas fees are settled from the outcome asset. A TWAP order consists of multiple smaller orders executed at regular intervals over a set time period. One of the standout features of CoWswap is its granularity in duration, allowing users to customize the period from minutes to months.

Highlights:

No fees

Granularity in Duration: from minutes to months

How to create a TWAP order?

A user selects the ERC-20 tokens they wish to swap. Then, the user fills in the price protection percentage, a feature that safeguards against future price movements. The TWAP order will not execute if the price dips below the specified percentage. Following this, the user specifies the Number of Parts - the segmentation of the order. Then, the user provides the total duration, which determines how long the order should take to complete. After inputting all this information, the protocol calculates how long CoW Swap will wait between each segment of your order, i.e., Part Duration, as well as the value of each sell and buy part.

Let's take an example, A user wants to swap USDT for WETH. The user selects both tokens and enters $1000 as the amount they wish to exchange. Then, they enter a price protection percentage, and the protocol calculates and indicates that it won’t execute the order if it's above the calculated amount. After this, the user inputs the number of partsThen, the duration, which is 1 hour. Based on these inputs, it calculates and shows the time between the orders, which is 30 minutes, and the part amount.

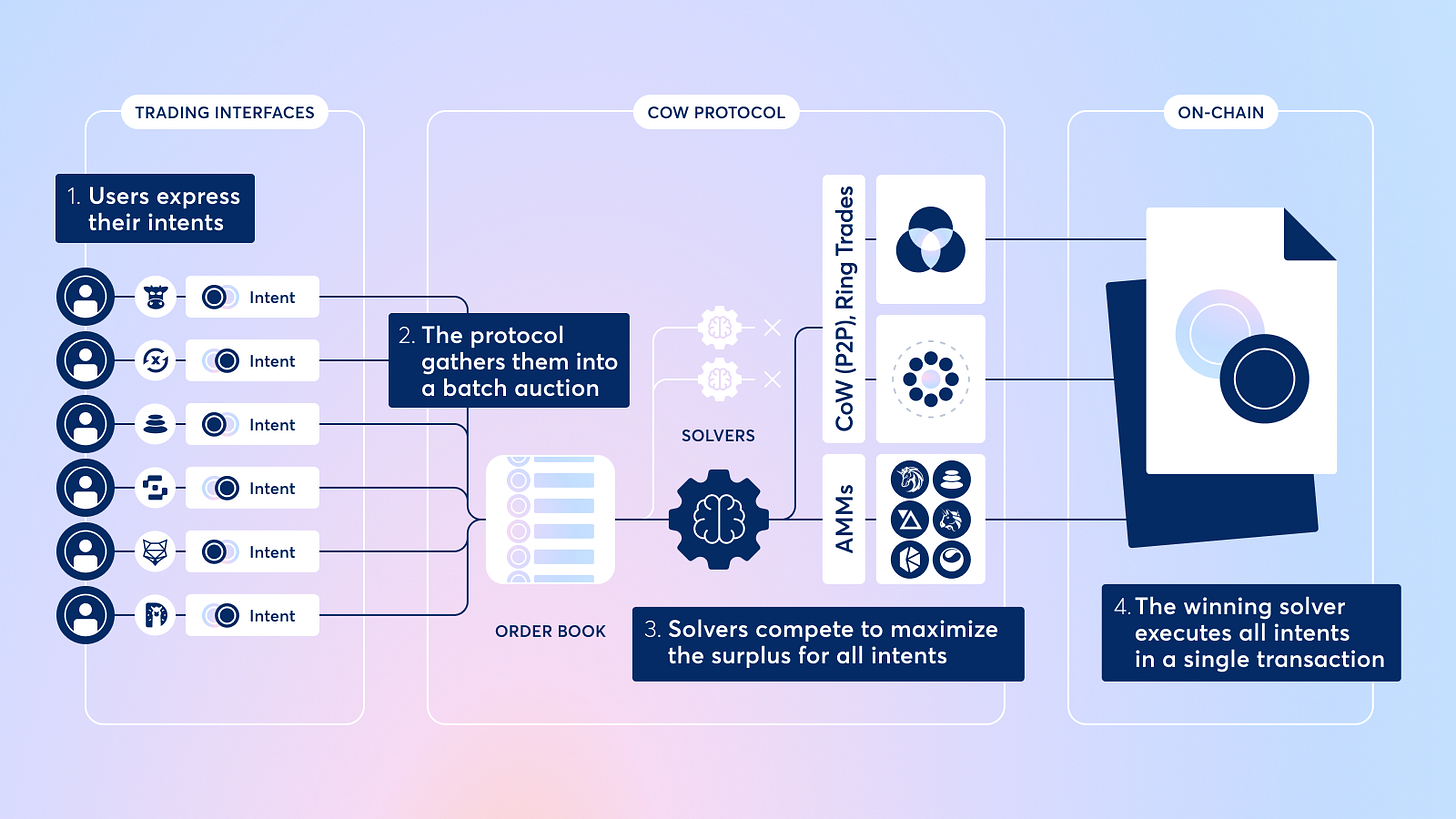

How does TWAP work?

TWAP orders divide a large order into a series of standard limit orders executed at fixed intervals. Users convey their trading intentions by signing messages that detail the assets and amounts they wish to trade, along with other parameters. The protocol consolidates the intentions of multiple users into a batch auction. Solvers are given a fixed amount of time to suggest settlements for the batch. The solver that generates the highest surplus for the batch is named the winner. This winning solver then submits the batch transaction on-chain on behalf of the users. After the winning solver has executed the batch's orders on-chain, users receive their tokens.

Definitive

Website: https://www.definitive.fi/ | Twitter: https://twitter.com/DefinitiveFi

Definitive is an execution platform that offers automation services for DeFi user operations. It streamlines DeFi execution for end-users, from high-frequency trading algorithms to complex yield strategies, positioning itself as an institution-grade execution environment. It is live on six EVM Chains: Ethereum, Arbitrum, Optimism, Polygon, Base, and Avalanche. TWAP orders, which can also be considered as DCA orders, are part of their product offerings. They charge a 0.25% platform fee for each Advanced Order, which includes Limit and TWAP orders.

Highlights:

Availability on 6 Chains

Order Granularity

Optimized for Traders

How to create a TWAP order?

Initially, a user needs to sign up through email login. A user should click on the deposit button, then select a chain from the widget, the token they wish to swap, and the amount of it. For TWAP orders, a user needs to have a vault for execution, so the UI will automatically display information to sign vault permissions, then mint the vault, incurring a one-time gas fee. Afterward, the user should be able to deposit the token. Then, select TWAP from the client, and choose the buy and sell assets. Next, a user has the option to enter a limit price for this TWAP order. Following this, the duration for the order ranges from 15 minutes to 30 days. Based on the selected duration, the protocol will apply the best segments for the order or simply split parts of the order. Here, a user also has the option to customize it according to their knowledge. Definitive also offers price protection for the order, meaning a user can set a percentage per segment order; if the price of the asset drops below/high as per the trade, it will not execute the order, protecting the user from sudden price impacts in the market. To enhance the experience, Gas fees are not paid separately; they are settled from the outcome asset. A user can cancel the order at any time.

How does the TWAP work?

The Definitive Vault is the smart contract responsible for execution. It consists of modules, each with specific logic for each function. As a user signs the order, functions are triggered, and based on the user's input and third-party inputs such as market price, orders are executed and met.

DefiSaver

Website: https://defisaver.com/ | Twitter: https://twitter.com/DeFiSaver

Defisaver is an asset management tool that helps users create, manage, and track their lending protocol positions from one place. It creates a smart-account wallet for each user to manage all actions. Defisaver enables users to create DCA orders, which are technically automated strategies performing periodic swaps between two selected tokens. It is available on Mainnet, Optimism, and Arbitrum. A fee of 0.3% is charged on each order, except for stablecoin pairs. Defisaver could benefit from adding more granularity.

How to create a DCA order?

A user selects both asset pairs they wish to swap, available as per the chain and mentioned in the UI. Then, they enter the desired time period after which the swap should execute: 1 day, 3 days, 7 days, etc. If you are a first-time user of DCA, you need to set up a smart-account wallet powered by Safe. This process is automated by the protocol; as a user, you first pay a gas fee to create a Safe account, then pay a gas fee for token approval, and then sign the automation order, and your DCA order is live. Note: The swap will continue until your entire wallet is used up, so it's better to use a separate Safe wallet for this, which is available on the app. Users can cancel the order anytime.

How does it work?

DeFiSaver DCA order is technically an automated strategy of a normal swap order. An automation strategy comprises conditions (triggers) and actions (recipes). Once certain conditions related to an order are met, the actions get executed. Actions can be thought of as transactions a user would normally perform, but here, they are executed by a DeFi Saver bot. The bot does not hold any permissions to access the user's funds directly. An authorization system is integrated, allowing these bots to be called into action once a user signs an order.

Stackly

Website: https://www.stackly.app/ | Twitter: https://twitter.com/Stacklydapp

Stackly is an app specifically designed to facilitate the creation of DCA orders, developed by the team at Swapr, they have reimagined the DCA or repeat order as the concept of "stacks," where a user essentially stacks a token. They developed a very intuitive UI, which provides an excellent user experience. Built on top of the CoWswap TWAP mechanism, it is available on Mainnet and Gnosis Chain. According to their official Dune data, they had 258 stacks and around $88k in deposits from users to date. It charges a one-time fee of 0.25% on the total amount.

Highlights:

Granularity in Duration: minutes, hours etc.

No Need to setup any accounts, works with EOAs.

How to create a Stack?

A user chooses the asset they wish to swap and stack. Then, they select a time period, determining how often the user wants to stack - from hours to months. And it’s done; your order to stack is created as per the input. A user can cancel the order at any time.

How does it work?

When a user deposits into the Stackly Smart-contract, based on the information provided by the user for the swap, Stackly has a "watch tower" function in its contracts that calls the CoW API to facilitate a successful swap. This systematic approach ensures that users' orders are processed smoothly, aligning with their specified stacking preferences and frequency.

Brokkr Finance

Website: https://brokkr.finance/ | Twitter: https://twitter.com/BrokkrFinance

Another protocol on the list is Brokkr Finance, which is live on Avalanche and Arbitrum. It serves as an asset and liquidity management platform, featuring three broad products: UniV3 strategies, Indexes, and DCA. According to Defillama, it has a TVL of around $136K. Users are limited to using USDC for swaps, and there are only five assets available for the swap. In terms of frequency, it supports weekly orders. Currently, there is no information regarding any platform fee.

How to create a DCA order?

With USDC.e as the sole base asset supported for swaps, users must choose which asset they wish to swap to. Available assets on Arbitrum include ARB, ETH, DPX, MAGIC, RDNT, and on Avalanche: BTC.b, WETH, WAVAX, JOE, GMX. Following this, users need to select the frequency of their orders: 4, 12, 26, and 52 weeks. An order is divided over the selected period, e.g., 12 weeks = 12 parts/tranches of the order.

Neon Protocol

Website: https://neonprotocol.io/ | Twitter: https://twitter.com/NEONprotocolio

Neon Protocol focuses exclusively on DCA as its core product, offering three sub-DCA products: DCA In/Out, DCA Cross-Chain, and DCA Interest Bearing. It is live on Arbitrum, Zksync, Base, Linea, and Mantle. "DCA In/Out" refers to a straightforward DCA that facilitates token swaps on the same chain. Cross-Chain DCA allows for a base asset on chain A to be swapped for a desired asset on chain B, with Neon supporting multiple chains depending on the provider and asset type's availability on that specific chain. Lastly, DCA Interest Bearing involves a simple swap on the same chain, but the swapped token is deposited into a pool that accrues yield, dependent on the token type and destination chain, with integrations including Beefy, Curve, and Convex. It charges a flat fee of $2.5.

How to create a DCA order?

A user selects the input token, from the menu or by entering the contract address, then chooses the output asset. Next, they enter the amount to be swapped and the destination chain of the output token, as it supports Cross-Chain DCA. If selecting the same chain, there is an option to choose a strategy for the asset, which would be Interest Bearing DCA. Users also have the option to specify a different destination address. Then, they select the execution type: limited or unlimited, indicating whether the order should execute only once or multiple times. After approving the token, the position is created. Positions can be canceled or reactivated.

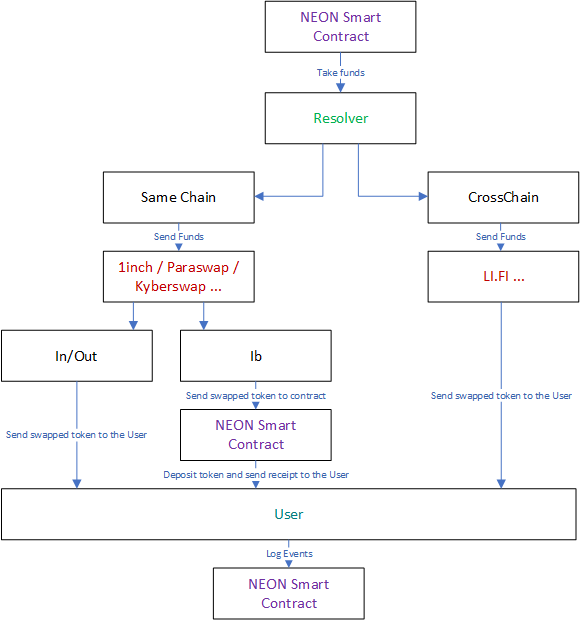

How does the DCA work?

NEON operates under a system known as the Process Layer, which consists of various contracts and a resolver that interact with one another. The contracts manage the DCAs and contain the necessary logic. The resolver acts as the automation enabler of the protocol, responsible for periodically checking the contracts to see if any actions need to be executed. When required, it performs the Swap and Cross-Chain processes.

Superfluid

Website: https://www.superfluid.finance/ | Twitter: https://twitter.com/Superfluid_HQ

Superfluid is a streaming and distribution protocol designed for subscriptions, salaries, vesting, etc., operating on the concept of Super Tokens, which extend the ERC-20 token standard. The Super Token standard allows for adding dynamic balances to tokens on-chain. Any token can be transferred in Superfluid streams or distributions, which are programmable, composable, and modular. One of Superfluid's use cases is TCA - Token Cost Averaging, designed to use the power of Superfluid streams. This application enables users to swap tokens in continuous, real-time streams: streaming in your Sell token and periodically receiving the Buy token.

How does it work?

As described in their documentation, any app utilizing Superfluid streaming technology can perform time-continuous swaps using a Time-Weighted Average Price (TWAP) oracle for liquidity source aggregation and to ensure a fair price over time. A user needs to wrap their normal ERC-20 token into a Super Token. For instance, if a user wants to TCA USDC to ETH, they first wrap their USDC into USDCx. Then, the swap takes place; this implementation could vary depending on how projects built atop it utilize it. After conversion, the user receives ETHx, which is a Super Token, and thus needs to unwrap it to the standard ERC-20 version. These actions involve gas fees for wrapping, unwrapping, and creating and cancelling the stream.

There are two projects that have implemented Superfluid TCA: Ricochet Exchange and Superboring.

Ricochet Exchange

Website: https://ricochet-exchange.eth.limo/ | Twitter: https://twitter.com/ricochetxchange

This platform is one of the oldest implementations of the protocol, starting in 2021. According to their end-of-2022 metrics, their v2 version, which went live in March 2022, processed half a million in volume that year. Ricochet's Discord and Twitter have shut down as of now. Their website is live, but the product was not accessible. (If anyone from the team is reading this, please provide an update on the status of the project.)

Superboring

Website: https://app.superboring.xyz/en | Twitter: https://twitter.com/SuperBoring_xyz

Superboring is mentioned as in beta on their website, Superboring is still in its early stages, with no documentation, Discord, or detailed information about the product available. I tried the product, and it worked. It currently supports only Optimism and three assets: OP, USDC, and ETH. There is no information about any platform fees. Superboring is in beta and appears to be in the early stages of development.

Comparison of Platform Fee and Supported Chains:

* This fee is for non-stablecoin pairs, ex - USDC<>WETH.

On mainnet and gnosis chain, Cowswap seems the best option as there is no platform fee, and the asset price it gives for the swap. For other chains, Definitive could be interesting to explore as it’s platform fee is the lowest.

In conclusion, the EVM ecosystem offers a variety of DCA products tailored to different user personas. For those who are simpler and not as savvy, Mean Finance and Stackly would be well-suited. Meanwhile, for the more advanced users, Cowswap and Definitive present themselves as intriguing options to explore. As this cycle unfolds, many people have come to realize that buying low and selling high remains one of the best and simplest strategies in crypto. With the increased adoption and access to stablecoins, and income-generating products like Perps, a significant number of users could use profits from these products to invest in and purchase tokens, potentially leading to a broader adoption of DCA apps.