Exploring Crypto Treasury Management Systems

As per Cryptorank, Q1 2024 saw a total VC deal value of around $2.3 billion, and according to Galaxy Research, the entire year of 2023 had around $9.8 billion worth of deal value. Stablecoins hover around $150 billion, and DeepDAO shows around $30 billion in DAO treasuries—all these signals indicate that there is significant capital on-chain. With VC funding, we can expect that some percentage of it is on-chain funds, so there is a lot of money to be managed. Finance and Ops teams require tools to manage all this, which are treasury management tools.

Having worked in this space for the past two years, one thing I've observed is that many people get confused with the term treasury management systems—is it optimization for the return on assets vs. financial operations? Traditionally, day-to-day financial operations are categorized into Cash Management, and the overall optimization of financial assets, liabilities, and cash is Treasury Management.

This confusion also arises in crypto because, in the Tradfi world, Fiat is the only currency—so cash management is separate, and your equity, real estate, etc., are the assets that need to be optimized. However, in crypto, your token could be treated as your asset or as currency. Obviously, currency (cash) is also an asset, but in fiat, it’s 1:1; its value remains the same. Here, it could be your project token, which could have a fluctuating value. Because of this, cash and treasury management solutions get merged into a single solution. One also needs to understand how treasury management evolves before and after the Token Generation event of a project. I have tried to cover all these points, focusing on what tools the ecosystem offers today.

Understanding Treasury Management

There are a few basic questions surrounding treasury management: How do crypto protocols manage their treasury? How is a protocol treasury formed? A protocol consists of smart contracts, with code that dictates certain functions based on inputs/outputs. Take Aave, for example, a lending and borrowing protocol—essentially a bank. It allows users to deposit funds, and borrowers can borrow from the pool. Borrowers pay interest to lenders, calculated based on the type of asset borrowed, its demand and supply, among other variables. In all these steps, Aave takes a fee, forming its treasury. While this example pertains to Aave, each protocol has its own operational method. In this process, everything is written in code, automatically rebalancing when a borrower gets liquidated or when funds are added or removed. This is a key differentiator and highlight for crypto protocols.

Teams specifically work on maximizing protocol revenue and optimizing protocol health by monitoring health factors, demand/supply, etc., of the assets that can be lent or borrowed. Aave token holders act as decision-makers in these processes, all of which are conducted on-chain. Teams like AaveChan, Karpatkey, Gauntlet etc assist in decision-making. These teams are compensated from the protocol-generated fees. Additionally, there are individual and part-time contributors, and tools that help ease and automate payments, invoices for these operations are part of DAO tooling solutions.

Protocols are self-accounting by nature, but the ecosystem extends beyond these protocols to include other products like Data, Developer tools, etc. Thus, there's a fine line between the finance of a protocol—how it generates revenue and other financial operations. These functions are self-executory, as defined by code. However, aspects such as vendor payments and contributor salaries are not fixed and can vary from quarter to quarter, which falls under finance operations.

Let's understand more. How does a crypto product come into picture? There is a founder, who has an idea, now to execute this a team and capital is required. Capital can be solved by raising from VCs, angels, ICOs, self capital or in grants. Founder forms a company, and this company is a legal entity, and this gets registered in a geography depending upon factors. Now as a business, it needs to regulate its finances - keep a check on how much is the current run-rate and how much is required to sustain, and other questions. As it is crypto, a team could have its capital on-chain or off-chain, meaning on blockchain and fiat(bank accounts). Around fiat, it has been done for so long, so there are already solutions for this. But, what about on-chain management of funds? So here treasury management solutions come into picture, they help manage these funds, and particularly on-chain, but now extending to off-chain via integrations. This is the process before the TGE. After the TGE, as a DAO will spin up, DAOs are usually foundations, and the initial or originating company is a separate entity; thus, this entity still needs to manage its finances as it was doing previously. Now, an extra process of DAO finance begins, which DAO teams need to take care of.

How does funds get stored on-chain? Or if you were starting, where would you store your funds? There are various instruments to store funds on-chain such as EOAs, smart-contract wallet, MPCs and private custody providers. Now, funds are stored on a blockchain, but it depends on the instrument how safe it is. For treasuries to keep funds on-chain there are two most used instruments: smart-contract wallet(multisig) and MPCs. And the reason for that is very simple, first of all business treasury is usually large that the risk of capital always remains a risk, then as it's a business - it's a corporate - it's not an individual money so there needs to be a multi-party owner for that wallet.

Another question, How to do business payments such as salaries to employees, payment to vendors and receiving income? Blockchains are p2p networks, so anyone can easily do a transfer. But, is it optimized for a corporate use-case? What does this mean? As there are many employees in a company, can we transfer their salary in a single transaction? Or could we settle multiple vendor payments at one. Blockchain allows it, a tool is required to support it for a normal user. And as a business, it needs to maintain its book. A transaction gets recorded on a blockchain, if you take a look at etherscan, it shows to and from, and a token used for the transaction. So blockchain does not know what context this transaction is done for? Now, one can say we can include information in the meta-data while doing a transfer, adding information for non-tech people is a friction, plus it is not a scalable approach. Is this a salary transfer or a vendor payment? So, we need to have a tool where we record narration while doing a transfer. Blockchain should act as a sub-ledger for crypto teams, which is provided by these solutions.

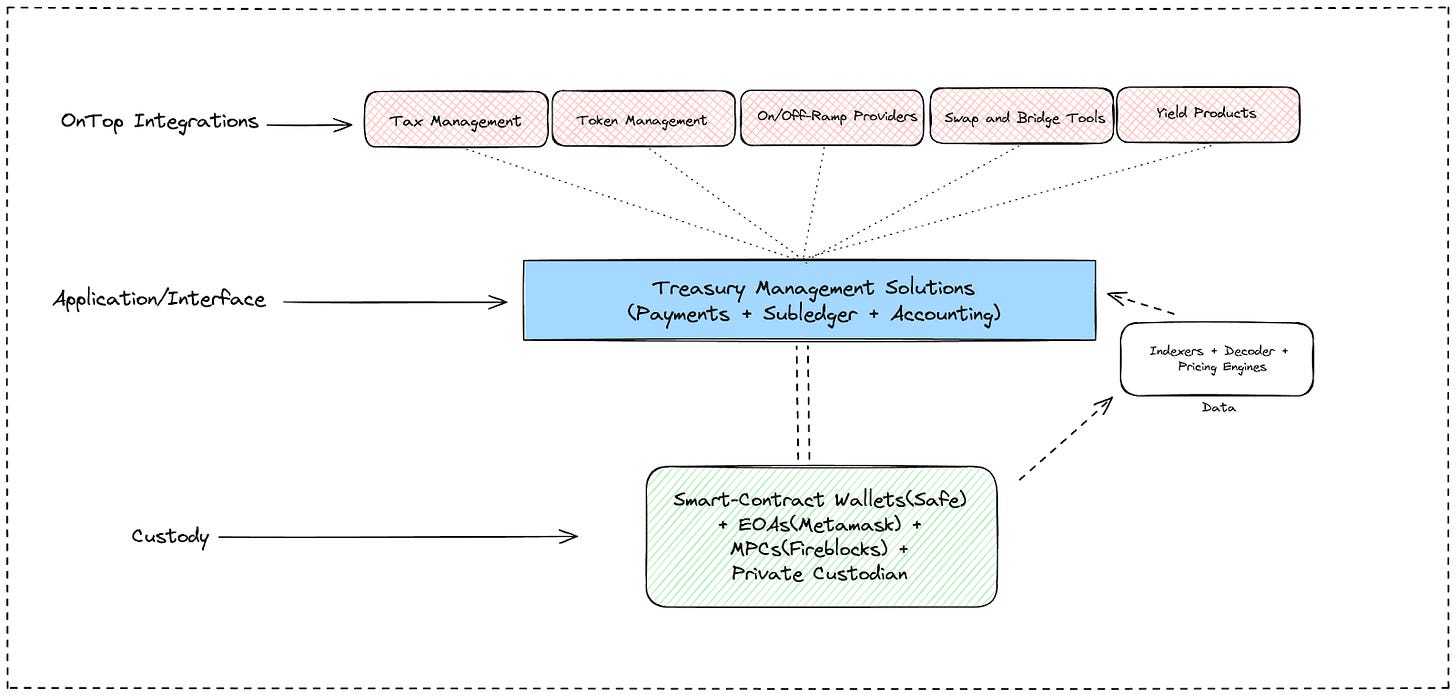

Crypto treasury management systems are product-based solutions that help manage financial operations such as salaries, vendor payments; aggregating wallets and transactions, categorizing them—acting as a subledger, generating accounting reports to understand the current state, and prospecting insights about the future. They also support asset management through integration with on-chain dapps. These are also known as Enterprise and Corporate Spend Management tools in Web2 SaaS. DAO tooling can be part of this or sometimes the same; it usually depends on the product and team's positioning.

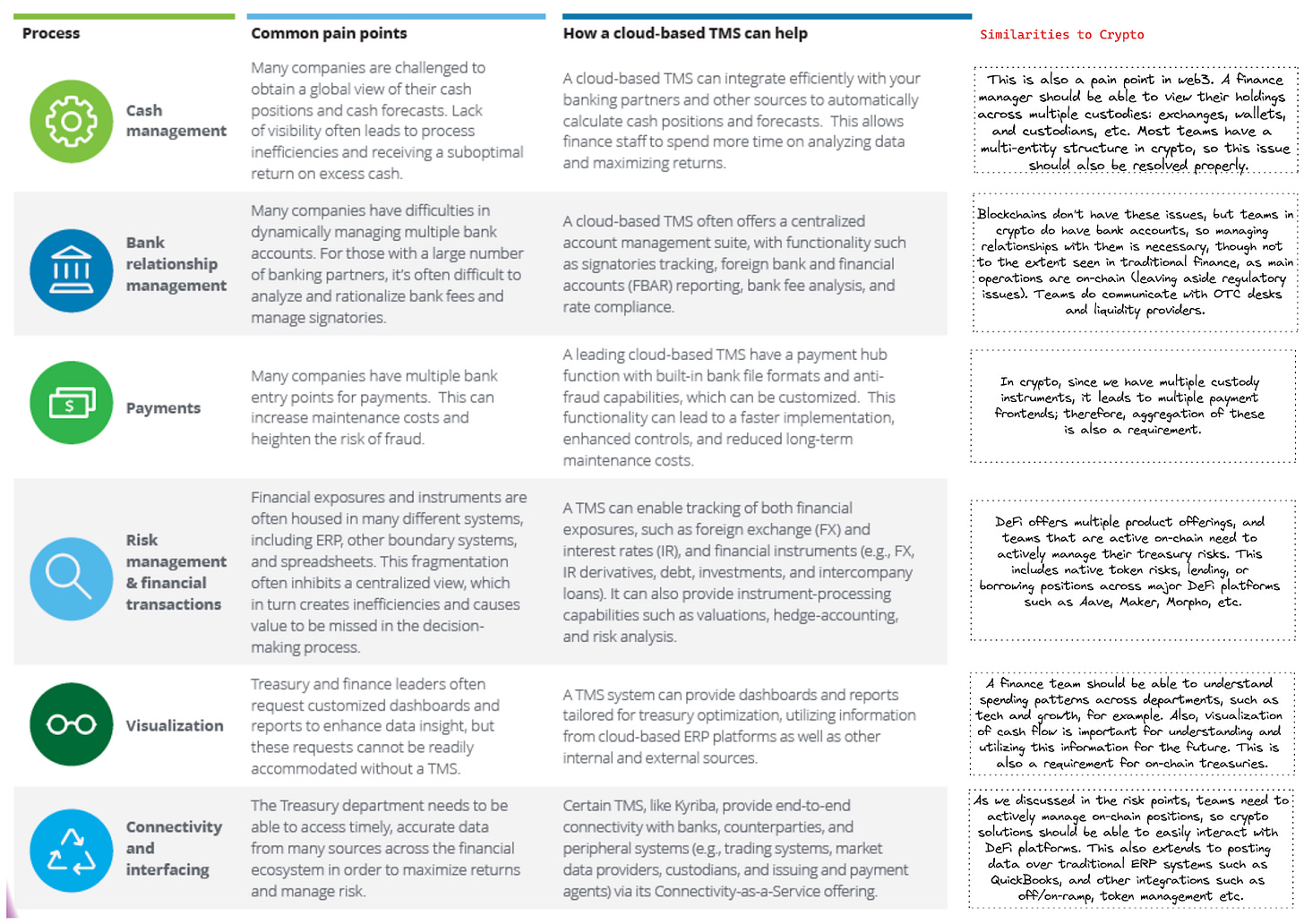

The above image is from Deloitte's Treasury Management system offering. From the image, we can conclude that the traditional functions include: Cash Management, Bank Relationship Management, Payments, Risk Management, Visualization, and Connecting Interfacing. These also apply to crypto. I have drawn similarities to the crypto version of these functions in the image.

Highlights in the ecosystem:

The narrative around financial tooling began in early 2022, with most of the funding, including Series A and Seed rounds, occurring that year. Since then, there has been significant activity in the ecosystem up to the present.

In late 2023, teams began to monetize. Previously, most projects were free to use, but then teams introduced monthly and yearly plans. On average, the basic plan starts at $100-200 per month, the mid-tier at $400-500 per month, and the highest tier at around $1000 and above per month. These are generalized tiers; each product offers its own plan.

2023 was marked as a year of shutdowns. Multis, a startup that had received Series A funding, shut down in September 2023. The founder informed users via email, citing the reason that the addressable market was too small for sustainable growth, and hinted at pivoting to a different route. The following month, Utopia Labs, another Series A-funded startup, announced it was shutting down its treasury management product and pivoting to a new product.

In 2023, acquisitions were predominantly seen among accounting-specific products. Gilded was acquired by Bitwave, and Tactic was acquired by Taxbit.

In 2024, Consola was acquired by Request Finance. Safe recently acquired Multis, and its senior team has joined Safe to work on cross-chain wallet infrastructure.

Starting from the bottom to the top as per our stack, in the custody layer, lets look at smart-contract and MPC based solutions.

Safe

Safe, which started in 2017 and was originally known as Gnosis Safe, is a smart-contract wallet featuring multi-signature capabilities. The main highlight for Safe is that its smart-contract has not been hacked to date, which implies the highest level of trust in it. This trust, compounding over time, leads every project to place its treasury into a Safe multisig. Safe has secured more than $100 billion worth of assets in its smart contract.

Safe has evolved into an infrastructure layer, opening opportunities for applications to be built on top of it. Now, every major crypto on-chain treasury management tool is built on top of it or supports it. There are niche use cases such as payments, accounting, and vesting. Safe also has its own frontend, which is now branded as Safe Wallet. It performs a limited function to support payouts, etc. It is a generalized frontend tool, not optimized for any particular use case.

Avocado

Avocado, a smart-contract wallet, was launched last year by the team at Instadapp. It introduced itself with features such as gas and network abstraction, including the ability to pay gas fees with USDC and maintaining the same address across all supported EVM chains. Additionally, Avocado has focused on providing easy-to-use recovery options. They are still relatively new in terms of being utilized as a treasury solution by projects.

MPC-based custody solutions also feature some major players: Fireblocks, Copper, Anchorage Digital, Qredo, Utila, Coinbase Institutional, Fordefi, Fiona, etc. All of the solutions offer an MPC-based wallet as part of their custody solution. They position themselves as tailored for institutions. Some also provide hardware custody solutions for larger clients such as banks and exchanges. These platforms have multiple product offerings as part of their stack, including an MPC-based wallet, Wallet as a Solution, OTC market with an internal network, Staking as a service, etc. These are some of their common features.

Now, let’s move one level up to a more app-specific layer, which involves treasury management solutions. These products may offer all functionalities: cash and spend management, accounting, and asset management, while some might offer only some of these features.

Request Finance

As of their latest update in March 2024, they have processed over $700 million. Request supports both crypto and fiat operations and is utilized by contractors as well as small to large companies. Companies can manage and make payments to their vendors, receive invoices and payments from clients, run payroll, and reimburse expenses. Request Finance has recently acquired Consola Finance, an accounting provider, enabling companies to manage their business books and sync their financial transactions with ERPs such as QuickBooks, Xero, etc. Request is also used by individual contractors who can easily keep track of their payments from clients, issue, and manage invoices.

Integral

Integral began as an accounting-focused tool for web3 teams, then expanded to payment operations. It offers automated solutions for bookkeeping, treasury management, tax compliance, and auditing, etc. Its main highlight, according to the team, is the ability to handle a high volume of transactions. It covers the entire stack for a web3 finance team, aggregating all kinds of custody: exchanges, wallets and other custodians. Users can set up automation for various processes, such as auto-categorization and sync to ERP systems. Teams can manage vendor payments, income from clients, and salaries to employees in the app; in-app transactions get auto-reconciled. It has integration with Plaid, so users can view their fiat treasury in a single dashboard.

Coinshift

Coinshift is a multi-chain treasury management solution that simplifies treasury operations for users, covering payments, reporting, and asset management. It allows users to create multiple organizations under one account, enabling teams to easily manage sub-departments. For treasury operations, it offers features such as Mass Payouts, Coinshift Dapps—interacting with apps such as Aave, Cowswap, etc., Role-Based Access Control, and Proposals for better multisig ops management. On the reporting side, it provides a unified dashboard covering multiple chains at once. Users can export historical transactions with labels and notes; it also features a cash flow tracker, which provides insight into money movement in the given time period. Users can also set up notifications for Discord and Slack.

Headquarters

HQ positions itself as the Finance OS for web3 teams, simplifying payments, accounting, and financial reporting—all from one app. It features an aggregated view of wallets, allowing users to view both custodial and non-custodial wallets, as well as the ability to create wallet groups. Users can make payments, powered by Disperse and Safe. It also enables the creation of a personalized link that can be used to collect income. For bookkeeping, it allows users to tag transactions, track realized gains and losses, etc. It has integration with Xero, one of the ERP providers, enabling users to sync their transactions. It also automates certain processes: Contacts, Assets, and Wallets.

Safe Treasury

Safe Treasury is a treasury management tool for web3 teams and DAOs. It allows setting up multiple projects within one interface. It supports Safe, EOAs, and centralized exchanges. Teams can run their payroll or any kind of payment from the app. For payroll, teams can save employee information within the app to save time and ensure authenticity. It also has a Cashflow dashboard that shows incoming and outgoing value from the wallet over a period of time. For bookkeeping, users can label transactions, attach invoices, and add descriptions to transactions. It also features a security log. One of the features for DAOs is the Public Treasury Dashboard; a user can share a customized public dashboard link, which is real-time, with its community.

OnChainDen

Den allows finance teams to manage on-chain operations such as payments, along with accounting and financial reports. It only supports Safe, and Den has optimized its experience for a better experience with Safe, especially around multisig operations. It helps in coordinating, understanding, and creating transactions for web3 teams. It offers a lightweight experience using the app. Users can batch multiple transactions into one and use a custom builder for a better experience. It also simulates transactions. For bookkeeping, users can add descriptions to transactions; it has a rules feature that automates the categorization of transactions. It also allows users to generate balance sheet and P&L reports. Users can also set up notifications to coordinate better.

Mural Pay

Mural Play positions itself as a global payments platform. It allows users to open a digital account, which is powered by Safe, and also connect to a fiat bank account. A user could set up as an organization or an individual. It has integrated Passkeys into the setup flow, abstracting many hurdles for the user. Now, a user can easily log in with their biometrics. Users can perform both on-ramp and off-ramp transactions. Users can generate monthly statements for accounting purposes. It allows the export of transactions in an ERP-ready format, which can be imported into ERP systems.

Rotki

Rotki is one of the only open-source solutions in the space; it provides portfolio tracking, accounting, and analytics. Rotki is built with values of privacy and ownership. Users need to install a Rotki client on their desktops, which allows all financial data to be stored in the local environment, as opposed to other providers which use a centralized cloud system. A user can view their non-custodial wallets and also connect to centralized exchanges. It also tracks DeFi holdings across major protocols. Users can even calculate profit and loss for their positions. It tracks individual staking positions as well. Users can perform on-chain swaps too.

I have tried to cover some of the products, check out the remaining ones too. Creating the right tool in crypto is a complex task, many finance teams still manage their finances using spreadsheets today, which requires a significant amount of time and manual effort. Some features that have become a must for a treasury management solution:

Aggregation of the Custody Layer:

Crypto is diverse, and teams depending on their setup use different custody solutions; some use Fireblocks + Safe, while others might use only Coinbase + EOA. A tool should support the major custodies used and provide an aggregated view to offer clear visibility across all treasury assets. This should include exchanges, non-custodial, and custodial solutions.

Off-chain and On-chain Support

As an extension of the first point, for a finance team to function effectively, it needs oversight over both fiat and on-chain funds. An ideal tool would integrate off-chain funds, such as bank accounts, with solutions like Plaid offering this capability. This could further extend to not just reading but also writing capabilities, supporting transfers from a single UI for both fiat and crypto.

Financial Planning and Analysis

Every business needs to conduct financial planning and analysis for the future. A tool should be capable of generating financial reports such as Profit and Loss, Monthly Balance, etc., to provide clear insights to the finance team. Moreover, a dashboard to analyze current spending and optimize treasury management is crucial.

Integration with Traditional ERP system:

Since books are still maintained via traditional ERP systems for most projects, integration with ERPs such as NetSuite, QuickBooks, etc., is essential.

Automation:

Automation is a key and impactful feature that can save teams a lot of time and effort. Simple features like tagging transactions to/from a specific wallet, or tagging transactions above/below a certain amount, could make a significant difference and ability to sync transactions to ERPs.

Fiat on-ramp and off-ramp:

At this stage, multiple third-party solutions exist for on and off-ramping, such as Transak. Teams should use these partners to support fiat payouts to contributors and vendors.

Public Treasury Dashboard:

A shareable and customizable dashboard that provides an overview of the entire treasury can be impactful, especially for sharing information with external stakeholders like investors and auditors, as well as internally with the team.

Multi-Entity and Multi-Currency Support:

As crypto teams are registered in different locations, and have multiple entities, having a proper parent-child entity structure, with multi-currency adds a lot of value.

‘’Data is the challenge’’ - Understanding the role of Data for crypto treasury solutions

Data is a pivotal element for treasury solutions to provide clarity to their users. Obtaining accurate and complete data for transactions is fundamental for these tools to offer comprehensive support. How do you view your transactions? You go on Etherscan, enter your address, and view. Etherscan runs its own node operations to gather that data. However, for each chain, separate nodes need to be run, which is expensive and a process in itself. There are tools like Covalent that provide this data. Since this involves financial information, transparency is crucial, making the indexer's role very crucial. Ideally, data APIs should be able to track a wallet back to genesis and retrieve accurate information. Now, this information just represents tokens moving in and out. We need to attach a fiat value to it, adding another layer of complexity. Additionally, as crypto operates 24/7, with prices changing every second and various sources to feed a price for a token, from a Uniswap pool to a centralized exchange order book price. Moreover, as transactions should be traceable back in history, the price of the token at that time should also be available. This is just the first part of the problem.

As we move more on-chain, defining what transactions actually are and what that means becomes the second part of the problem. A transaction could appear as multiple smart-contract interactions, but what actually happens could be different, making this a tough problem for a data tool. Another related problem is the calculation of Profit and Loss. This concept seems straightforward, because Profit = Selling Price - Buying Price. However, in the DeFi world, when you supply liquidity to Uniswap v3 pools, it mints an NFT position. This NFT position doesn’t have a price attached to it; if you were to realize the position, the NFT gets burned, and you receive the supplied asset back. So, if we were to look at it on Etherscan or another transaction tool, it would appear as an NFT minting transaction, making the calculation of profit and loss a challenge.

One ecosystem can produce demand for other ecosystems, let's discover those areas related to treasury management solutions that would be used by the same set of end users or treasury solutions.

Tax Management Solutions

It is an entirely different product segment, as tax is a very geography-centric thing. Each country has its own laws regarding it, so complying with all that and actively monitoring the laws, as these laws are always changing, and mapping crypto data to your IRS website, requires a different level of integration. There are specific players, such as Cointracker and Taxbit, working on this. Treasury management solutions could explore integrations with these platforms, easily facilitated through APIs.Token/Cap table Management

Token management is one of the niche problems in this space. Depending on its roadmap, a project goes through a token generation event. The team needs to prepare for pre-token to post-token activities. Token vesting, cliffs, and lockups all need to be designed and executed, which is where these platforms help. Additionally, they help streamline the documentation process related to token documents, such as employee contracts.On-Ramp and Off-Ramp Providers

On/Off- Ramp providers are used by Treasury solutions to support bank account transfers. Teams need to pay to their contractors and employees, and in crypto its global, off-ramp helps them. There are solutions such as Transak, MoonPay etc.Swap and Bridge Tools

To manage on-chain funds, teams need to exchange their assets for another asset, which could be for any possible reason - paying for a service, an employee, diversification of the treasury, etc. Swap and bridge tools help treasury operators to do it.Yield Products

For asset management, treasury operators need yield-generating products for investment or diversification purposes. DeFi offers a ton of opportunities, including lending and borrowing protocols such as Aave, staking on native chains, restaking, and US treasury, made possible by RWA protocols. Teams could get exposure to these opportunities through treasury solutions.

Final thoughts: the future is aggregated. An ideal platform would aggregate all kinds of custody providers, aggregate payments, integrate fiat accounts, enable accounting and reporting, and provide tax and token management services. It doesn't mean that a team needs to build everything themselves; specific use cases could be covered through deep integrations with other projects. This aggregation could act as an attraction for users, allowing a CFO to perform every possible function within one interface. We can observe this with current products available in the market; they either start with payments or accounting and expand into each category. Payments are tough to monetize, considering the biggest advantage of blockchain is that payments are close to free. So, providing integrated services - accounting, reporting, etc., could allow teams to generate revenue. This value proposition could remain consistent while we are a group of small teams. As our space matures and the average headcount begins to increase, we will likely move to a more modular approach, which is an application for a specific function.